Shipping internationally doesn’t have to be complicated—but missing documents, unclear invoices, or incorrect shipment classification can quickly lead to delays, extra charges, or rejected shipments.

Whether you’re sending documents or goods, understanding the right shipping requirements is essential for smooth delivery. In this guide, we break down Aramex’s key shipping guidelines, from document versus non-document shipments to invoice requirements, destination-specific rules, and essential customs paperwork—so you can ship with confidence.

Document vs non-document shipment

A document shipment, as the name suggests, includes paper-based or printed materials such as letters, contracts, certificates, or other important documents. These shipments do not contain commercial goods and are generally processed with fewer customs requirements.

In contrast, any international shipment that does not contain documents is classified as a non-document shipment. This includes products, samples, merchandise, or any item with a commercial value.

Important to know: Document shipments do not require an invoice, while non-document shipments must always be accompanied by an invoice for customs clearance.

What is an invoice

An invoice is a legally binding document issued by the shipper for all goods shipments, in line with customs, tax, and trade rules of the export, transit, and import countries. It serves as the main document for customs clearance, tax calculation, payment processing, and legal compliance.

What to include in an invoice

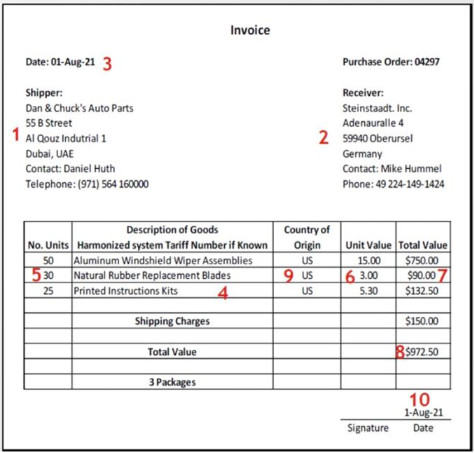

Ensure the invoice includes the following elements:

- Shippers’ information: details including address and phone number.

- Consignee information: details identifying the recipient.

- Invoice’s date: date the invoice was issued.

- An adequate description of each commodity in the shipment.

- Commodity description to be accurate and not just “documents”, “sample”, “as per invoice”, “clothes”.

- You can refer to this guidance document published by the European Commission with examples of unacceptable/acceptable waybill goods descriptions.

- Number of units of each commodity.

- Individual value of each unit.

- Line value of the individual commodity being shipped.

- Total value of the entire shipment.

- Country of origin – where each commodity was manufactured.

- Shipper signature or stamp.

Why an invoice is required

An invoice acts as the shipment’s “passport” into the destination country. Without it, customs authorities cannot process the goods, and your shipment will not be allowed entry.

Customs teams rely on the invoice to determine duties, taxes, and regulatory requirements—something a packing slip cannot replace. As with all shipments submitted to Aramex, the shipper’s information must be fully completed to avoid delays.

Invoices may also be referred to as:

- Export Documents

- Commercial Invoices

- Customs Control Documents

For non-document shipments, make sure all the details are complete, as missing or incomplete invoice details can cause the goods to be held at the origin. The most common invoice errors include:

- Missing invoice, item values or country of origin

- Inadequate or vague description of goods

- Missing or incorrect HS code

Related Reading: The secrets to affordable cross-border shipping for SMEs

Pro-forma invoice vs commercial invoice

A pro-forma invoice is a preliminary document that may be issued before shipping to support administrative or regulatory requirements. It usually contains estimated prices, product details, and shipment terms, but it is not used for customs clearance in place of a commercial invoice.

You may need a Pro-forma invoice when:

- Customs or the shipping provider requests additional shipment details

- The shipment is for temporary purposes, such as repair, testing, display, or consignment

- The document is needed for internal approvals, financing, or foreign exchange processes

Note: While helpful in certain cases, a pro-forma invoice is only supplementary. For non-document shipments, a commercial invoice remains mandatory.

Airwaybill for international air shipments

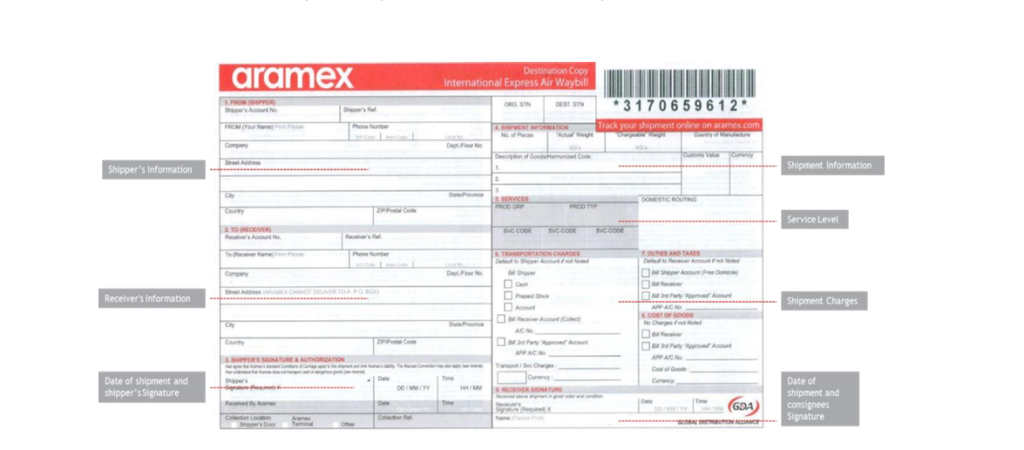

An Airwaybill (AWB) is a crucial document in the air freight industry that serves as the official contract of carriage between the shipper and the airline or logistics provider.

The AWB acts as proof of shipment and enables tracking throughout the delivery journey. Aramex customers can use Airwaybill-based shipping that is generated via Aramex.com or the ClickToShip application. It must include the following:

- Shipper details and consignee’s information— including name, full address, and contact number—must also be accurate.

- Each package should be labeled to show its sequence within the shipment (e.g., ‘1 of 1’ for a single parcel or ‘1 of 2’, ‘2 of 2’ for multiple parcels), and the total count should be verified.

- The selected product type will appear on the Airwaybill.

- All goods must be clearly and accurately described with specific and detailed item information

Mandatory documents by shipment type

Different shipment types require different supporting documents to ensure smooth customs clearance so always make sure you have the required documents.

The table below provides a quick overview of the mandatory documents required for common shipment categories.

| Shipment type | Mandatory documents |

| All cash shipments | Shipper ID |

| All non-document shipments | Invoice with HS Code |

| HV B2B/B2C shipments | Exporter Code |

| Fz (Free-zone) shipments | Delivery Advice, Invoice, Packing list |

| ELI/ELM shipments | MSDS (Material safety data sheet) |

| DG (dangerous goods) shipments | DG Onboarding |

Please note that mandatory documentation may vary depending on the destination country and the nature of the shipment. Additional documents may be requested by customs authorities based on local regulations.

Table below illustrates some examples:

| Destination | Invoice (non-Docs) | Invoice (docs) | Receiver ID | Valid Telephone Number | Email ID |

| Oman | Yes | Yes | Yes | ||

| China | Yes | Yes | |||

| Turkey | Yes | Yes | |||

| Japan | Yes | Yes | |||

| United Kingdom | Yes | Yes | Yes | ||

| France | Yes | Yes | Yes |

Related Reading: Struggling with shipping? Here’s how to fix your fulfilment fast

Bill of entry (UAE shipments only)

For UAE shipments you will need another document i.e. Bill of Entry (BOE). It is a legal document that importers must submit to customs when their goods arrive in the UAE. It declares what is being imported — including the type of goods, their quantity, and their value — so customs can calculate the correct taxes and clear the shipment for release.

Think of it as the official paperwork that tells customs exactly what’s in your shipment and ensures everything complies with import regulations. Without a BOE, the goods cannot be released from the port.

Please note that BOE processing fees and requirements are subject to change and may vary by shipment type. For the most accurate and up-to-date information, customers are advised to consult their local Aramex office.

Key takeaway: Get your documents right from the start

Successful international shipping starts with preparation. Clearly classifying your shipment, submitting the correct invoice, and ensuring destination-specific documents are in place can significantly reduce the risk of customs holds and unexpected charges.

Before shipping, take time to review your paperwork, verify commodity descriptions, and confirm country requirements. When in doubt, using Aramex’s shipping tools and support resources can help you avoid common documentation mistakes and ensure your shipment moves smoothly from origin to destination.

Got questions? Reach out to our experts or download our free guide here.